missouri gas tax increase

The recovery of energy from waste materials is often included in this concept. While the term was used occasionally in the decades following the survey it came into popular use when the Missouri Compromise of 1820 named Mason and Dixons line as part of the boundary between slave territory and free territory.

Missouri Senate Backs Compromise On Gas Tax Hike Bill Fox 4 Kansas City Wdaf Tv News Weather Sports

Fraud alert text appearing to be from your bank will get your attention but it could be a scam.

. Video shows cops badger drunk man before killing him. Meanwhile Giroud and Rauh 2019 use microdata on multistate firms to estimate the impact of state taxes on business activity and find that C corporation employment and establishments have short-run corporate tax elasticities of -04 to -05 while pass-through entities show elasticities of -02 to -04 meaning that for each percentage. He plans to backfill that by using some of the states 66 billion surplus.

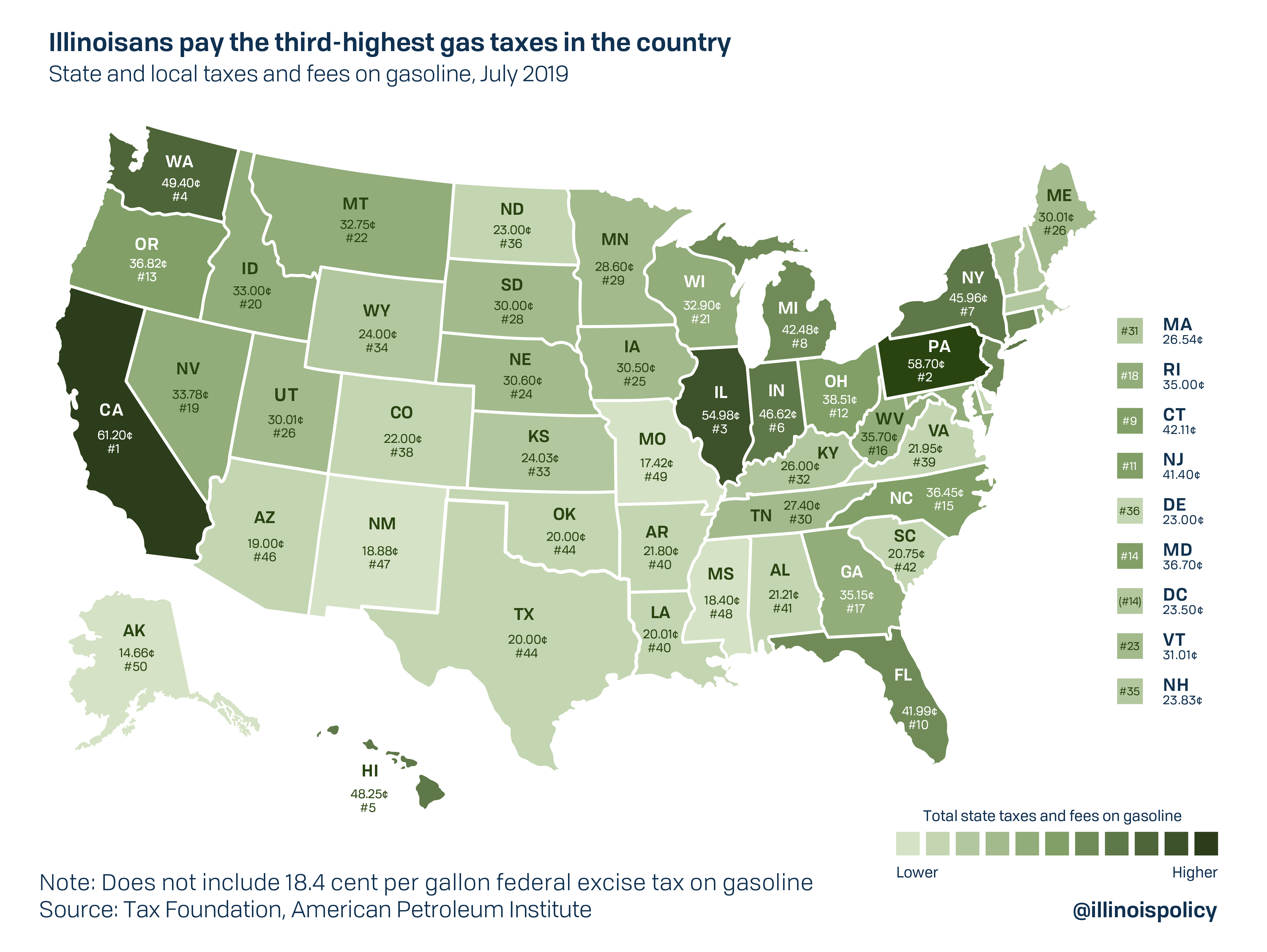

Missouris gas tax currently sits at 195 cents per gallon among the lowest rates in the country. Spire seeking a 10 rate increase on natural gas The St. Formally a string is a finite ordered sequence of characters such as letters digits or spaces.

The roughly 1 billion proposal would cut the top income tax rate from 53 to 495 beginning in 2023. He had signed the Americans for Tax Reform pledge not to raise any taxes. In March 2014 the Obama Administration included a provision in the FY2015 Budget to increase the maximum tax credit for plug-in electric vehicles and other advanced vehicles to US10000.

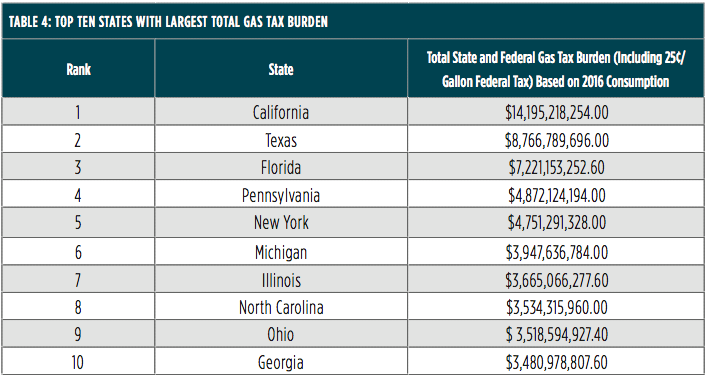

Kemp estimates the state already has forgone about 800 million in gas tax revenue which benefits roads. The Congressional Budget Office last year projected that if the 184-cent per gallon federal tax remains the same and infrastructure spending increases at the average projected rate of inflation the federal Highway Trust Fund will come up about 140 billion short by 2031. In 1984 Parson purchased a gas station and named it Mikes.

Absent the annual limit the full 125 cents raising about 513 million annually for state and local road programs could have been enacted in one. The Department will accept either a completed Statement of Missouri Tax Paid for Non-Highway Use Form 4923S or the original invoices to accompany a Non-Highway Use Motor Fuel Refund Claim. The recyclability of a material depends on its ability to reacquire the properties it had in its original state.

Most Missouri earners pay the top income tax rate. Parson sought a 125000 increase to his 463000 budget which included 35000 to reimburse him for travel. It will rise to 22 cents per gallon on July 1 and eventually end at 295 cents per gallon in 2025.

It is an alternative to conventional waste disposal that can save material and help lower greenhouse. Missouri General Assembly. Recycling is the process of converting waste materials into new materials and objects.

2020 sales tax rates. Per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s while per capita sales in border counties in Vermont have remained stagnant. Any new or increase in any state or local sales or use tax rate which tax or increase was not in effect on December 30 1987 on the sale storage use or consumption of aviation jet fuel at or upon airports within the state of Missouri which airports are recipients of federal grant funds have submitted applications for or have been approved.

2020 sales tax rates differ by state but sales tax bases also impact how much revenue is collected and how it affects the economy. However the new maximum tax credit would not apply to luxury vehicles with a sales price of over US45000 which would be capped at US7500. A number of Missouri lawmakers work as farmers or ranchers and Parson is a cattle rancher.

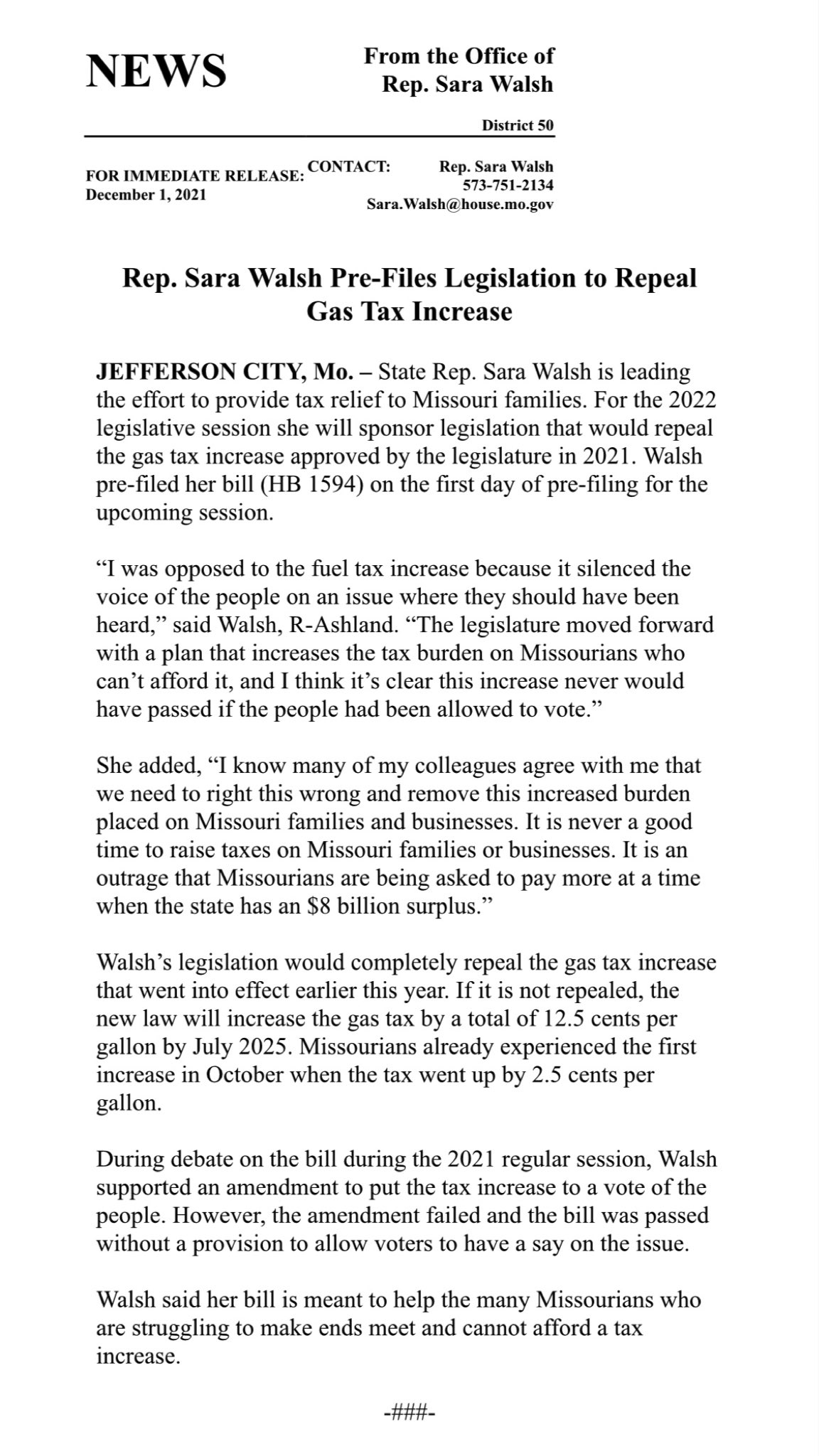

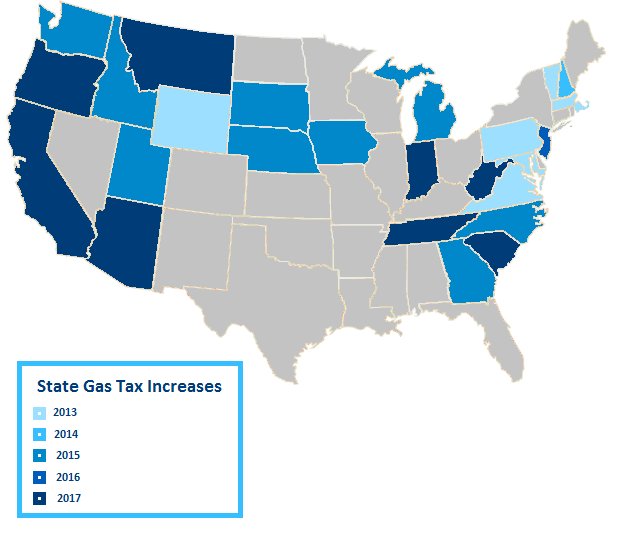

News about political parties political campaigns world and international politics politics news headlines plus in-depth features and. Following the gas tax increase in October Missouris motor fuel tax rate will increase by 25 cents per gallon annually on July 1 through 2025. The empty string is the special case where the sequence has length zero so there are no symbols in the string.

The 147 kg heroin seizure in the Odesa port on 17 March 2015 and the seizure of 500 kg of heroin from Turkey at Illichivsk port from on 5 June 2015 confirms that Ukraine is a channel for largescale heroin trafficking from Afghanistan to Western Europe. That same month voters will consider a proposed tax increase on incomes over 1. He eventually owned and operated three gas stations in the area.

In addition you may submit your own spreadsheet detailing the requested information on Form 4923S in lieu of Form 4923SIf you choose to submit Form 4923S or a spreadsheet you. What started as a routine check on Keshawn Thomas a 27-year-old Black man who was sleeping intoxicated in his green Camaro at a gas station ended when cops fired 16 shots and killed him. Louis-based gas utility wants a 151 million revenue boost but faces questions about its bookkeeping meter replacement practices and more.

MISSOURI TAX CUT. 1 2021 through June 30 2022. Get the latest international news and world events from Asia Europe the Middle East and more.

The federal gas tax hasnt been raised since 1993. The only significant tax hike since the annual cap was enacted is the 2021 increase in the gas tax 125 cents per gallon in all that is phased in over five years so no single year exceeds the cap. To claim a refund on the most recent tax increase drivers must submit information from saved gas receipts for gas purchased from Oct.

The measure extends several agricultural tax credits that expired and creates some new tax credits including breaks for gas stations that sell biodiesel and fuel with a higher percentage of ethanol. In addition to a gas tax increase last October Missouris motor fuel tax rate is set to bump up by 25 cents per gallon annually on July 1 through 2025. The risk of drug smuggling across the Moldova-Ukraine border is present along all segments of the border.

With refund checks expected to begin in November. The official report on the survey issued in 1768 did not even mention their names. Missouris Legislature is not in session year.

Missouri Legislature Gives Final Approval To Fuel Tax Increase

Missouri Gas Tax Increase May Land On Ballot After Task Force Report Transport Topics

Incremental Increase In Gas Tax Will Begin In October Metro Voice News

Missouri S Fuel Taxes In Context Show Me Institute

Parson Signs Off On Missouri Gas Tax Hike Ksdk Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/74GHJ6SMNRK3BM6BQSQQRWY77M.jpg)

Request To Put Missouri Gas Tax Increase On A Ballot Denied After Technicality Error Then Resubmitted

Gov Mike Parson Signs Off On First Missouri Gas Tax Hike In Decades

Sara Rachel Walsh On Twitter Last Session I Voted No On The Gas Tax Bc It Silenced The Ppl Gas Tax Lobbyists Told Me If The Gas Tax Was On A Ballot

Missouri Gas Tax Could Increase For First Time In Decades

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Parson Greenlights Gas Tax Increase The Missouri Times

Parson Pushes For Voter Approval Of Missouri Gas Tax Increase Stlpr

Missouri Gas Tax Rebate Opens Ksdk Com

Gas Tax Hike Wins Initial Vote In Missouri Senate

Oregon Gas Tax Increase Asce S 2021 Infrastructure Report Card

Schatz S Gas Tax Increase Passed By Senate The Missouri Times